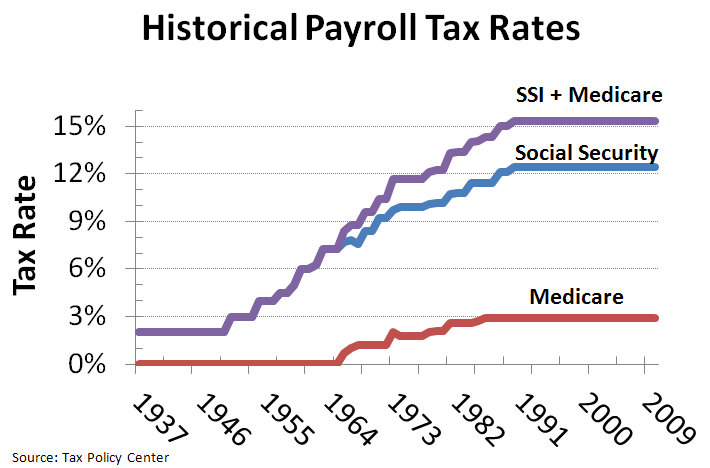

Image credit: http://commons.wikimedia.org/wiki/File:Historical_Payroll_Tax_Rates.jpg

There is no Social Security Trust Fund and every tax dollar collected was immediately spent on wars and other slop. The SS Trust Fund was left with a worthless pile of IOU's totaling nearly $3 trillion, courtesy of thieving Congress Critters.

For decades, the Social System was nothing but a cash cow for the government because receipts far exceeded disbursements but that changed a few years ago. The cash cow croaked and SS is running a deficit - meaning disbursements exceed receipts. This requires the federal government to up the rate of interest it pays on the debt (treasuries) or dip into the general fund to finance SS payment obligations.

If SS was running a consistent surplus for many decades, then why did the government keep raising the tax? It's a valid question, especially given that nearly $3 trillion vanished into the spending hole. The answer to the question is that both Republicans and Democrats plundered the SS Trust fund to finance wars. The largest increase in the SS tax included LBJ and Reagan years; not only was the SS tax increased, the Medicare tax introduced in 1966 by LBJ at .7% but was quickly raised to 2.9%. Medicare is also bankrupt, even more bankrupt than SS because Medicare is basically an unfunded entitlement while SS is a plundered and looted entitlement that still generates significant cash.

It's interesting to note how the 2% SS tax grew from 2% to 15.3% and what presidents were responsible for the largest increases in SS-Medicare taxes. LBJ and Reagan were both ferociously loyal to the military industrial complex and both used SS-Medicare taxes to fun the MIC.

| [hide]Historical Social Security Tax Rates Maximum Salary FICA and/or SECA taxes paid on[9] | ||||||||

|---|---|---|---|---|---|---|---|---|

| Year | Maximum Earnings taxed | OASDI Tax rate | Medicare Tax Rate | Year | Maximum Earnings taxed | OASDI Tax rate | Medicare Tax Rate | |

| 1937 | 3,000 | 2% | - | 1977 | 16,500 | 9.9% | 1.8% | |

| 1938 | 3,000 | 2% | - | 1978 | 17,700 | 10.1% | 2.0% | |

| 1939 | 3,000 | 2% | - | 1979 | 22,900 | 10.16% | 2.1% | |

| 1940 | 3,000 | 2% | - | 1980 | 25,900 | 10.16% | 2.1% | |

| 1941 | 3,000 | 2% | - | 1981 | 29,700 | 10.7% | 2.6% | |

| 1942 | 3,000 | 2% | - | 1982 | 32,400 | 10.8% | 2.6% | |

| 1943 | 3,000 | 2% | - | 1983 | 35,700 | 10.8% | 2.6% | |

| 1944 | 3,000 | 2% | - | 1984 | 37,800 | 11.4% | 2.6% | |

| 1945 | 3,000 | 2% | - | 1985 | 39,600 | 11.4% | 2.7% | |

| 1946 | 3,000 | 2% | - | 1986 | 42,000 | 11.4% | 2.9% | |

| 1947 | 3,000 | 2% | - | 1987 | 43,800 | 11.4% | 2.9% | |

| 1948 | 3,000 | 2% | - | 1988 | 45,000 | 12.12% | 2.9% | |

| 1949 | 3,000 | 2% | - | 1989 | 48,000 | 12.12% | 2.9% | |

| 1950 | 3,000 | 3% | - | 1990 | 51,300 | 12.4% | 2.9% | |

| 1951 | 3,600 | 3% | - | 1991 | 53,400 | 12.4% | 2.9% | |

| 1952 | 3,600 | 3% | - | 1992 | 55,500 | 12.4% | 2.9% | |

| 1953 | 3,600 | 3% | - | 1993 | 57,600 | 12.4% | 2.9% | |

| 1954 | 3,600 | 4% | - | 1994 | 60,600 | 12.4% | 2.9% | |

| 1955 | 4,200 | 4% | - | 1995 | 61,200 | 12.4% | 2.9% | |

| 1956 | 4,200 | 4% | - | 1996 | 62,700 | 12.4% | 2.9% | |

| 1957 | 4,200 | 4.5% | - | 1997 | 65,400 | 12.4% | 2.9% | |

| 1958 | 4,200 | 4.5% | - | 1998 | 68,400 | 12.4% | 2.9% | |

| 1959 | 4,800 | 5% | - | 1999 | 72,600 | 12.4% | 2.9% | |

| 1960 | 4,800 | 6% | - | 2000 | 76,200 | 12.4% | 2.9% | |

| 1961 | 4,800 | 6% | - | 2001 | 80,400 | 12.4% | 2.9% | |

| 1962 | 4,800 | 6.25% | - | 2002 | 84,900 | 12.4% | 2.9% | |

| 1963 | 4,800 | 7.25% | - | 2003 | 87,000 | 12.4% | 2.9% | |

| 1964 | 4,800 | 7.25% | - | 2004 | 87,900 | 12.4% | 2.9% | |

| 1965 | 4,800 | 7.25% | - | 2005 | 90,000 | 12.4% | 2.9% | |

| 1966 | 6,600 | 7.7% | 0.7% | 2006 | 94,200 | 12.4% | 2.9% | |

| 1967 | 6,600 | 7.8% | 1.0% | 2007 | 97,500 | 12.4% | 2.9% | |

| 1968 | 7,800 | 7.6% | 1.2% | 2008 | 102,000 | 12.4% | 2.9% | |

| 1969 | 7,800 | 8.4% | 1.2% | 2009 | 106,800 | 12.4% | 2.9% | |

| 1970 | 7,800 | 8.4% | 1.2% | 2010 | 106,800 | 12.4% | 2.9% | |

| 1971 | 7,800 | 9.2% | 1.2% | 2011 | 106,800 | 10.4% | 2.9% | |

| 1972 | 9,000 | 9.2% | 1.2% | 2012 | 110,100 | 10.4% | 2.9% | |

| 1973 | 10,800 | 9.7% | 2.0% | 2013 | 113,700 | 12.4% | 2.9% | |

| 1974 | 13,200 | 9.9% | 1.8% | |||||

| 1975 | 14,100 | 9.9% | 1.8% | |||||

| 1976 | 15,300 | 9.9% | 1.8% | |||||

| Notes:

Tax rate is the sum of the OASDI and Medicare rate for employers and workers.

In 2011 and 2012, the OASDI tax rate on workers was set temporarily to 4.2% while the employers OASDI rate remained at 6.2% giving 10.4% total rate. Medicare taxes of 2.9% now (2013) have no taxable income ceiling. Sources: Social Security Administration, [40] and [41], accessed 7 Nov 2013 | ||||||||

Social Security and Medicare taxes are like property taxes - you have the tax rates plus the base or assessment on which they were assessed.

Medicare did not exist until LBJ created it in 1966 with a tax rate of .6 that was quickly raised to 1.2% by LBJ. This was on top of LBJ's 16% increase in the SS tax from 7.25% to 8.4%. Even worse, LBJ raised the base a whopping 63% from $4,800 to $7,800. It's how LBJ funded the Vietnam War.

But the prize for the biggest SS tax hikes in history go to Reagan who raised the SS tax from 10.16% to 12.12%, in addition to raising the Medicare tax from 2.1% to 2.9%. But Reagan also raised the base from $25,700 to $48,000, nearly doubling the taxable base by a whopping 86%.

These taxes fell squarely on the poor and middle class who obviously pay the brunt of SS and Medicare taxes.

Reagan's SS-Medicare tax hikes combined with the increase in the wage base on which these taxes were paid constituted the biggest tax hike on the poor and middle class in US history, AFTER the Federal Reserves' wholesale robbery of the purchasing power of the dollar.

After Nixon de-tethered the dollar from gold in 1971, the purchasing power of the dollar rapidly declined and was permanently decimated. During the Reagan years, the poor and middle class were hit with monster SS and Medicare tax on wage dollars that were buying less and less. Still, every president and congress since SS was enacted has plundered the SS Trust Fund and left a worthless pile of IOU's. Reagan, with bipartisan support, managed to royally screw the poor and middle class on a level unheard of in US history.

To put SS tax rates into perspective especially as it pertains to both the rate and the ever increasing base, the best example is Teresa Heinz Kerry who disclosed her tax returns when hubby John Kerry ran for president. Teresa Heinz Kerry, who is worth $200 million according to celebritynetworth.com, paid a paltry federal tax rate of 12% on unearned income (dividends and interest) in excess of $5 million, here and here, in 2003.

When the richest folks in America pays much lower tax rates than the poor and middle class, something is radically wrong.

In America, the minimum tax rate for the poor and middle class starts with a floor of 15.3%, a rate that doesn't include federal taxes, state taxes, sales taxes and various other taxes designed to gouge ordinary working stiffs and the poor.

And if the ordinary folks think that the government is saving their money for them and their future retirement, they are brain dead and delusional. Yeah, it's an absolute tragedy that damn few Americans even know what the government did with their so-called retirement savings. Spending SS and Medicare taxes on wars and other slop is just another pathetic example of the thieving powers of government whose only goal is to plunder the people. And plundering the people is the only thing that government is good at.